Avg 2016 Archives

avg 2016 Archives

Gaia ADQL example queries

ConeSearch sorted by distance

Use case: I want to retrieve all the objects in a catalogue in a circular region centered at (,) with a search radius of 5 arcmin ( deg).

Target table: www.spearpointsecuritygroup.com_source

SELECT DISTANCE( POINT('ICRS', ra, dec), POINT('ICRS', , )) AS dist, * FROM www.spearpointsecuritygroup.com_source WHERE 1=CONTAINS( POINT('ICRS', ra, dec), CIRCLE('ICRS', , , )) ORDER BY dist ASCCone search filtered by magnitude, ordered by magnitude Galactic centre, radius 5'

Use case: I want to retrieve all the objects in a catalogue in a circular region and apply an additional selection criterion (magnitude in this case).

Target table: www.spearpointsecuritygroup.com_source

SELECT * FROM www.spearpointsecuritygroup.com_source WHERE 1=CONTAINS( POINT('ICRS',ra,dec), CIRCLE('ICRS',,, )) AND phot_g_mean_mag>=10 AND phot_g_mean_mag<15 ORDER BY phot_g_mean_mag ASCTGAS catalogue filtered by magnitude and parallax

Example of simple query filtered by logical conditions. Use case: I want to retrieve all the stars in a close region (shell) around the Sun and apply an additional selection criterion (magnitude in this case)

Target table: www.spearpointsecuritygroup.com_source

SELECT * FROM www.spearpointsecuritygroup.com_source WHERE parallax >= 15 AND parallax <= 50 AND phot_g_mean_mag >= 9 and phot_g_mean_mag <=ADQL positional cross-match: Hipparcos vs Gaia, 1" radius

In case of catalogues with dissimilar size, the smaller one should be used to define the “point” and the larger to create the “circle”. The performance can be degraded by several orders of magnitude otherwise.

Note only the first 10 objects are retrieved to make the query fast.

Remove the “top 10” statement to retrieve the full diagram

Use case: I want to carry out a positional cross-match between two catalogues.

Note that several pre-computed cross-matches against major surveys is available in the Gaia Archive.

SELECT TOP 10 * , distance( POINT('ICRS', www.spearpointsecuritygroup.com, www.spearpointsecuritygroup.com), POINT('ICRS', www.spearpointsecuritygroup.com, www.spearpointsecuritygroup.com)) AS dist FROM www.spearpointsecuritygroup.com_source AS gaia, www.spearpointsecuritygroup.comcos AS hip WHERE 1=CONTAINS( POINT('ICRS', www.spearpointsecuritygroup.com, www.spearpointsecuritygroup.com), CIRCLE('ICRS', www.spearpointsecuritygroup.com, www.spearpointsecuritygroup.com, ) )Built-in positional cross-match: Hipparcos vs Gaia, 1" radius

It can be faster than an ADQL cross-match in some cases, but requires login. The output is a user table, not a job (see Help -> ADQL syntax for further details)

Use case: I want to carry out a positional cross-match between two catalogues for further refinement within the Archive.

Note that several pre-computed cross-matches against major surveys is available in the Gaia Archive.

SELECT crossmatch_positional( 'public','hipparcos', 'gaiadr2','gaia_source', , 'xmatch_hipparcos_gaia') FROM dual;TGAS Healpix maps: source density, average good observations and excess noise

DR1. Gaia Collaboration, Lindegren et al. A&A A, 4L Figs. 5, 6 (adapted)

Note only the first 10 objects are used to make the query fast.

Remove the “top 10” statement to retrieve the full diagram.

Use case: I want the representation on the sky of some survey property.

SELECT TOP 10 gaia_healpix_index(6, source_id) AS healpix_6, count(*) / as sources_per_sq_deg, avg(astrometric_n_good_obs_al) AS avg_n_good_al, avg(astrometric_n_good_obs_ac) AS avg_n_good_ac, avg(astrometric_n_good_obs_al + astrometric_n_good_obs_ac) AS avg_n_good, avg(astrometric_excess_noise) as avg_excess_noise FROM www.spearpointsecuritygroup.com_source GROUP BY healpix_6Red clump stars. Absolute magnitudes within Hipparcos colour bin

DR1. Gaia Collaboration, Brown et al. A&A A, 2G Fig. 4

Use case: I want to estimate whether the Red clump absolute magnitude distribution is sharper (and thus a better define quantity) in TGAS compared to Hipparcos.

SELECT www.spearpointsecuritygroup.com_id, www.spearpointsecuritygroup.com, www.spearpointsecuritygroup.com_g_mean_mag + 5 * log10(www.spearpointsecuritygroup.comax) - 10 AS g_mag_abs_gaia, www.spearpointsecuritygroup.com_g_mean_mag + 5 * log10(www.spearpointsecuritygroup.com) - 10 AS g_mag_abs_hip FROM www.spearpointsecuritygroup.com_source AS gaia INNER JOIN www.spearpointsecuritygroup.comcos_newreduction AS hip ON www.spearpointsecuritygroup.com = www.spearpointsecuritygroup.com WHERE www.spearpointsecuritygroup.comax/www.spearpointsecuritygroup.comax_error >= 5 AND www.spearpointsecuritygroup.com >= 5 AND hip.e_b_v > and hip.e_b_v <= AND hip.b_v >= AND hip.b_v <= AND / log(10) * www.spearpointsecuritygroup.com_g_mean_flux_error / www.spearpointsecuritygroup.com_g_mean_flux <=Red clump stars

Red clump stars. Absolute magnitudes within Hipparcos colour bin

1D histogram computed within the Archive, bin = mag

DR1. Gaia Collaboration, Brown et al. A&A A, 2G Fig. 4 (adapted)

Use case: I want to estimate whether the Red clump absolute magnitude distribution is sharper (and thus a better define quantity) in TGAS compared to Hipparcos.

SELECT g_mag_abs_hip_index / 5. AS g_mag_abs_hip, count(g_mag_abs_hip_index) AS freq FROM ( SELECT floor((www.spearpointsecuritygroup.com_g_mean_mag + 5 * log10(www.spearpointsecuritygroup.com) - 10) * 5) AS g_mag_abs_hip_index FROM www.spearpointsecuritygroup.com_source AS gaia INNER JOIN www.spearpointsecuritygroup.comcos_newreduction AS hip ON www.spearpointsecuritygroup.com = www.spearpointsecuritygroup.com WHERE www.spearpointsecuritygroup.comax/www.spearpointsecuritygroup.comax_error >= 5 AND www.spearpointsecuritygroup.com >= 5 AND hip.e_b_v > and hip.e_b_v <= AND hip.b_v >= and hip.b_v <= AND / log(10) * www.spearpointsecuritygroup.com_g_mean_flux_error / www.spearpointsecuritygroup.com_g_mean_flux <= ) AS subquery GROUP BY g_mag_abs_hip_index ORDER BY g_mag_abs_hipTGAS-2MASS HR diagram

DR1. Gaia Collaboration, Brown et al. A&A A, 2G Fig. 5

Note only the first 10 objects are retrieved to make the query fast.

Remove the “top 10” statement to retrieve the full diagram.

Use case: I want to construct the TGAS HR diagram.

SELECT TOP 10 www.spearpointsecuritygroup.com_id, www.spearpointsecuritygroup.com_g_mean_mag + 5 * log10(www.spearpointsecuritygroup.comax) - 10 AS g_mag_abs , www.spearpointsecuritygroup.com_g_mean_mag - www.spearpointsecuritygroup.com_m AS g_min_ks FROM www.spearpointsecuritygroup.com_source AS gaia INNER JOIN www.spearpointsecuritygroup.com_best_neighbour AS xmatch ON www.spearpointsecuritygroup.com_id = www.spearpointsecuritygroup.com_id INNER JOIN www.spearpointsecuritygroup.com_original_valid AS tmass ON www.spearpointsecuritygroup.com_oid = www.spearpointsecuritygroup.com_oid WHERE www.spearpointsecuritygroup.comax/www.spearpointsecuritygroup.comax_error >= 5 AND ph_qual = 'AAA' AND sqrt(power( / log(10) * www.spearpointsecuritygroup.com_g_mean_flux_error / www.spearpointsecuritygroup.com_g_mean_flux, 2) ) <= AND sqrt(power(/log(10)*www.spearpointsecuritygroup.com_g_mean_flux_error / www.spearpointsecuritygroup.com_g_mean_flux, 2) + power(www.spearpointsecuritygroup.com_msigcom, 2)) <=TGAS-2MASS HR diagram

2D histogram computed within the Archive, mag bin size

DR1. Gaia Collaboration, Brown et al. A&A A, 2G Fig. 5 (adapted)

Note only the first 10 objects are used to make the query fast.

Remove the “top 10” statement to retrieve the full diagram.

Use case: I want to construct the TGAS HR diagram.

SELECT g_min_ks_index / 10 AS g_min_ks, g_mag_abs_index / 10 AS g_mag_abs, count(*) AS n FROM ( SELECT TOP 10 www.spearpointsecuritygroup.com_id, floor((www.spearpointsecuritygroup.com_g_mean_mag+5*log10(www.spearpointsecuritygroup.comax)) * 10) AS g_mag_abs_index, floor((www.spearpointsecuritygroup.com_g_mean_www.spearpointsecuritygroup.com_m) * 10) AS g_min_ks_index FROM www.spearpointsecuritygroup.com_source AS gaia INNER JOIN www.spearpointsecuritygroup.com_best_neighbour AS xmatch ON www.spearpointsecuritygroup.com_id = www.spearpointsecuritygroup.com_id INNER JOIN www.spearpointsecuritygroup.com_original_valid AS tmass ON www.spearpointsecuritygroup.com_oid = www.spearpointsecuritygroup.com_oid WHERE www.spearpointsecuritygroup.comax/www.spearpointsecuritygroup.comax_error >= 5 AND ph_qual = 'AAA' AND sqrt(power( / log(10) * www.spearpointsecuritygroup.com_g_mean_flux_error / www.spearpointsecuritygroup.com_g_mean_flux, 2)) <= AND sqrt(power( / log(10) * www.spearpointsecuritygroup.com_g_mean_flux_error / www.spearpointsecuritygroup.com_g_mean_flux, 2) + power(www.spearpointsecuritygroup.com_msigcom, 2)) <= )AS subquery GROUP BY g_min_ks_index, g_mag_abs_indexRR Lyrae phase folded light curve reconstruction, including errors

DR1. Gaia Collaboration, Brown et al. A&A A, 2G Fig. 7 (adapted)

Use case: I want to construct a phase-folded light curve for easier analysis and comparison to stars with different period.

SELECT www.spearpointsecuritygroup.comation_time, mod(www.spearpointsecuritygroup.comation_time - www.spearpointsecuritygroup.com_g, rrlyrae.p1) / rrlyrae.p1 AS phase, curves.g_magnitude, / log(10) * curves.g_flux_error / curves.g_flux AS g_magnitude_error FROM www.spearpointsecuritygroup.com_variable_time_series_gfov AS curves INNER JOIN www.spearpointsecuritygroup.come AS rrlyrae ON www.spearpointsecuritygroup.com_id = www.spearpointsecuritygroup.com_id WHERE www.spearpointsecuritygroup.com_id =Cepheids: light curve retrieval for all stars

DR1. Clementini et al. A&A A, A (adapted)

Use case: I want to retrieve all light curves of a given object class for offline analysis.

SELECT gaia.* FROM www.spearpointsecuritygroup.com_variable_time_series_gfov AS gaia INNER JOIN www.spearpointsecuritygroup.comd AS cep on www.spearpointsecuritygroup.com_id = www.spearpointsecuritygroup.com_idRR Lyrae: light curve retrieval for all stars

DR1. Clementini et al. A&A A, A (adapted)

Use case: I want to retrieve all light curves of a given object class for offline analysis.

SELECT gaia.* FROM www.spearpointsecuritygroup.com_variable_time_series_gfov AS gaia INNER JOIN www.spearpointsecuritygroup.come AS rr ON www.spearpointsecuritygroup.com_id = www.spearpointsecuritygroup.com_idCepheids: number of data points and estimated parameters

DR1. Clementini et al. A&A A, A (adapted)

Use case: I want high level information for a given class of variable objects.

SELECT www.spearpointsecuritygroup.com_observations_processed, cep.* FROM www.spearpointsecuritygroup.com_variable_time_series_gfov_statistical_parameters AS stat INNER JOIN www.spearpointsecuritygroup.comd AS cep ON www.spearpointsecuritygroup.com_id = www.spearpointsecuritygroup.com_idRR Lyrae: number of data points and estimated parameters

DR1. Clementini et al. A&A A, A (adapted)

Use case: I want high level information for a given class of variable objects.

SELECT www.spearpointsecuritygroup.com_observations_processed, rr.* FROM www.spearpointsecuritygroup.com_variable_time_series_gfov_statistical_parameters AS stat INNER JOIN www.spearpointsecuritygroup.come AS rr ON www.spearpointsecuritygroup.com_id = www.spearpointsecuritygroup.com_idProper motion propagation: Pleiades TGAS field in

Use case: I want to propagate Gaia positions to an epoch in the past for comparison against photographic plates astrometry.

SELECT source_id, ra, dec, coord1(prop) AS ra_, coord2(prop) AS dec_ FROM ( SELECT www.spearpointsecuritygroup.com_id, ra, dec, EPOCH_PROP_POS(ra, dec, parallax, pmra, pmdec, 0, ref_epoch, ) AS prop FROM www.spearpointsecuritygroup.com_source AS gaia WHERE contains( POINT('ICRS', www.spearpointsecuritygroup.com, www.spearpointsecuritygroup.com), CIRCLE('ICRS', , , 5)) = 1 AND sqrt(power(www.spearpointsecuritygroup.com - , 2) + power(www.spearpointsecuritygroup.com + , 2)) < ) AS subqueryCookie Privacy Manager

Some essential features on www.spearpointsecuritygroup.com won't work without certain cookies. Other cookies help improve your experience by giving us insights into how you use our site and providing you with relevant content. For more information, please check out our cookie policy here.

Strictly Necessary

These cookies provide a secure login experience and allow you to use essential features of the site

Analytics / Performance

Analytics cookies allow us to improve our website by giving us insights into how you interact with our pages, what content you&#;re interested in, and identifying when things aren&#;t working properly. The information collected is anonymous.

Targeting

We use targeting cookies to test new design ideas for pages and features on the site so we can improve your experience. We also collect information about your browsing habits so we can serve up content more relevant to your interests. Disabling these cookies would mean the content you see on the site might not be as relevant to you.

Table of Contents

Exhibit (a)(1)(A)

OFFER TO PURCHASE FOR CASH

All Outstanding Ordinary Shares of

AVG TECHNOLOGIES N.V.

at

$ Per Share

by

AVAST SOFTWARE B.V.

a direct wholly owned subsidiary of

AVAST HOLDING B.V.

THE OFFER AND WITHDRAWAL RIGHTS WILL EXPIRE AT P.M., NEW YORK CITY TIME, ON AUGUST 31, , UNLESS THE OFFER IS EXTENDED OR EARLIER TERMINATED.

Avast Software B.V., a private company with limited liability (besloten vennootschap met beperkte aansprakelijkheid) organized under the laws of The Netherlands (&#;Purchaser&#;) and a direct wholly owned subsidiary of Avast Holding B.V., a private company with limited liability (besloten vennootschap met beperkte aansprakelijkheid) organized under the laws of The Netherlands (&#;Parent&#;), is offering to purchase all outstanding ordinary shares, with a nominal value of &#; per share (the &#;Shares&#;), of AVG Technologies N.V., a public limited liability company (naamloze vennootschap) organized under the laws of The Netherlands (&#;AVG&#;), at a purchase price of $ per Share (the &#;Offer Price&#;), in cash, without interest and less applicable withholding taxes or other taxes, upon the terms and subject to the conditions set forth in this Offer to Purchase (the &#;Offer to Purchase&#;) and in the related Letter of Transmittal (the &#;Letter of Transmittal&#; and, together with this Offer to Purchase, as each may be amended or supplemented from time to time, &#;Offer&#;).

The Offer is being made pursuant to a Purchase Agreement, dated as of July 6, (as it may be amended from time to time, the &#;Purchase Agreement&#;), by and among AVG, Purchaser and Parent. Unless the Offer is extended or earlier terminated, the Offer will expire at p.m., New York City time, on August 31, (the &#;Expiration Time,&#; unless the Offer is extended in accordance with the Purchase Agreement, in which event &#;Expiration Time&#; will mean the latest time and date at which the Offer, as so extended by Purchaser, will expire). The Purchase Agreement provides, among other things, that, subject to the terms and conditions set forth therein, Purchaser will, promptly after the Expiration Time, accept for payment all Shares validly tendered pursuant to the Offer and not properly withdrawn (the time of acceptance of Shares for payment, the &#;Acceptance Time&#;) and, promptly after the Acceptance Time, pay for all such Shares (such time of payment, the &#;Offer Closing&#;). After the consummation of the Offer, we intend to cause AVG to terminate the listing of the Shares on the New York Stock Exchange. As a result, AVG would cease to be publicly traded. In addition, after the consummation of the Offer we intend to take steps to cause AVG to terminate or suspend its reporting obligations with the United States Securities and Exchange Commission (the &#;SEC&#;).

After due and careful discussion and consideration, including a thorough review of the Offer with their outside legal and financial advisors, AVG&#;s supervisory board (the &#;AVG Supervisory Board&#;) and management board (the &#;AVG Management Board,&#; and together with the AVG Supervisory Board, the &#;AVG Boards&#;) by unanimous vote of all directors present or represented and voting (a) approved the terms of, and the transactions contemplated by, the Purchase Agreement, the Asset Sale Agreement (as defined below) and all other documents conducive to AVG&#;s obligations under the Purchase Agreement (collectively, the &#;AVG Transaction Documents&#;), and approved AVG&#;s entry into the AVG Transaction Documents; and (b) determined to support the Offer and to recommend that AVG shareholders accept the Offer, subject to the terms and conditions of the AVG Transaction Documents. The AVG Boards also unanimously approved (i) the Asset Sale (as defined below), the subsequent Dissolution (as defined below) and the Liquidation Distribution (as defined below) and the appointment of a liquidator; (ii) the terms and conditions of the Asset Sale Agreement and the entry into the Asset Sale Agreement by AVG upon Purchaser&#;s request as set forth in the AVG Transaction Documents; and (iii) the proposed amendment of the articles of association of AVG if the Asset Sale (as defined below) is pursued and the proposed amendment of the articles of association of AVG and conversion of AVG into a private company with limited liability if the Asset Sale is not pursued.

Table of Contents

The AVG Boards unanimously support the Offer and recommend that AVG shareholders accept the Offer. The AVG Boards unanimously recommend that you vote &#;for&#; each of the items that contemplate a vote of AVG shareholders at the extraordinary general meeting of AVG shareholders scheduled to be held on August 23, at A.M., Central European Time, at the offices of Allen & Overy LLP, Apollolaan 15, AB Amsterdam, The Netherlands (the &#;EGM&#;). At the EGM, AVG shareholders will be requested to vote on the Asset Sale (as defined below), the Dissolution (as defined below), the Liquidation Distribution (as defined below), the appointment of the liquidator, the appointment of directors designated by Purchaser to the AVG Boards and other matters contemplated by the Purchase Agreement.

Following the Expiration Time, Purchaser intends to provide for a subsequent offering period (the &#;Subsequent Offering Period&#;) of at least 10 business days in accordance with Rule 14d under the Securities Exchange Act of (as amended from time to time and, together with the rules and regulations promulgated thereunder, the &#;Exchange Act&#;) and in accordance with the Purchase Agreement. The Subsequent Offering Period may be extended by Purchaser in accordance with the Purchase Agreement for at least seven business days following the announcement that Purchaser or its designee intends to effect the Asset Sale (as defined below) (such extension, the &#;Minority Exit Offering Period&#;). Under no circumstances will interest be paid on the Offer Price paid pursuant to the Offer, regardless of any extension of the Offer, the Subsequent Offering Period (which includes the Minority Exit Offering Period, if applicable), or any delay in making payment for Shares.

The Purchase Agreement provides, among other things, that, as promptly as practicable following the closing of the Subsequent Offering Period (which includes the Minority Exit Offering Period, if applicable), Purchaser may complete a corporate reorganization of AVG and its subsidiaries (the &#;Subsequent Reorganization&#;). The Subsequent Reorganization will utilize processes available to Purchaser under Dutch law to ensure that (a) Purchaser becomes the owner of all of AVG&#;s business operations from and after the consummation of the Subsequent Reorganization and (b) any AVG shareholders who do not tender their Shares pursuant to the Offer (or during the Subsequent Offering Period, which includes the Minority Exit Offering Period, if applicable) are offered or receive the same consideration for their Shares as those shareholders who tendered their Shares pursuant to the Offer (or during the Subsequent Offering Period, which includes the Minority Exit Offering Period, if applicable), without interest and less applicable withholding taxes (including Dutch dividend withholding tax (dividendbelasting)) or other taxes. As a result of the Subsequent Reorganization, it is anticipated that AVG will be liquidated or become wholly owned by Purchaser. The Subsequent Reorganization may also include the conversion of AVG from a public limited liability company (naamloze vennootschap) to a private company with limited liability (besloten vennootschap met beperkte aansprakelijkheid).

If the number of Shares tendered pursuant to the Offer and not properly withdrawn (including Shares validly tendered during the Subsequent Offering Period, which includes the Minority Exit Offering Period, if applicable, but excluding Shares tendered pursuant to guaranteed delivery procedures that have not yet been delivered in settlement or satisfaction of such guarantee prior to the Expiration Time), together with the Shares then owned by Parent, Purchaser and their respective subsidiaries, represents at least 95 percent of the then outstanding Shares,Purchaser intends to effect the Subsequent Reorganization by means of compulsory acquisition of Shares held by non-tendering AVG shareholders in accordance with Section a or Section a of the Dutch Civil Code (the &#;Compulsory Acquisition&#;).

Table of Contents

Sale Agreement&#;) in exchange for (a) cash and a note payable in an aggregate amount equal to the Offer Price multiplied by the total number of Shares outstanding as of the Offer Closing and (b) the assumption by Purchaser or its designee of substantially all liabilities of AVG (the &#;Asset Sale&#;).

Any Subsequent Reorganization other than the Compulsory Acquisition or the Asset Sale and the Dissolution requires the approval of the independent directors of AVG.

Upon consummation of the Asset Sale, Purchaser would own all of AVG&#;s business operations and would be the principal shareholder in AVG, and the non-tendering AVG shareholders would continue to own Shares representing, in the aggregate, a minority of the Shares then outstanding. Upon completion of the Asset Sale, AVG will be dissolved and liquidated in accordance with applicable Dutch liquidation procedures (the &#;Dissolution&#;). Purchaser would then provide an indemnity or guarantee to the liquidator for any deficit in the estate of AVG, to enable the liquidator to make an advance liquidation distribution in cash (the &#;Liquidation Distribution&#;) to each non-tendering AVG shareholder in an amount equal to the Offer Price, without interest and less applicable withholding taxes (including Dutch dividend withholding tax) or other taxes, for each Share then owned.

The applicable withholding taxes (including Dutch dividend withholding tax) and other taxes, if any, imposed on AVG shareholders in respect of the Liquidation Distribution are likely to be different from, and greater than, the taxes imposed upon such AVG shareholders had they tendered their Shares pursuant to the Offer (or during the Subsequent Offering Period, which includes the Minority Exit Offering Period, if applicable).

See Section 11 &#; &#;The Purchase Agreement; Other Agreements and &#;Section 12 &#; &#;Purpose of the Offer; Plans for AVG&#; of this Offer to Purchase.

The Offer is conditioned upon, among other things, the satisfaction or waiver (to the extent permitted by the Purchase Agreement and applicable law) of the following as of immediately prior to the Expiration Time: (a) the Minimum Condition (as defined below), (b) the Antitrust Clearance Condition (as defined below), (c) the Restraints Condition (as defined below), (d) the CFIUS Clearance Condition (as defined below) and (e) the Termination Condition (as defined below).

The &#;Minimum Condition&#; requires that there have been validly tendered pursuant to the Offer and not properly withdrawn a number of Shares (excluding Shares tendered pursuant to guaranteed delivery procedures that have not yet been delivered in settlement or satisfaction of such guarantee prior to the Expiration Time) that, together with the Shares then owned by Parent, Purchaser and their subsidiaries, represents at least 95 percent of, or, if AVG shareholders approve the Asset Sale, the Dissolution, the Liquidation Distribution and related matters contemplated by the Purchase Agreement at the EGM, at least 80 percent of, the Shares outstanding immediately prior to the Expiration Time.

The &#;Antitrust Clearance Condition&#; requires the expiration or termination of any applicable waiting period (and any extension thereof) applicable to the transactions contemplated by the Purchase Agreement under the Hart-Scott-Rodino Antitrust Improvements Act of (as amended, and together the rules and regulations thereunder, the &#;HSR Act&#;) and the expiration or termination of the applicable waiting period, or receipt of approval (which is in full force and effect and not subject to appeal), under the antitrust laws of Austria and Germany. Parent and AVG filed their Premerger Notification and Report Forms with the Federal Trade Commission and the Antitrust Division of the U.S. Department of Justice in connection with the transactions contemplated by the Purchase Agreement on July 27, The Offer is also subject to other conditions as described in this Offer to Purchase. See Section 15 &#; &#;Certain Conditions of the Offer.&#;

The &#;Restraints Condition&#; requires that there is not in effect any law, regulation, order, or injunction entered, enacted, promulgated, enforced or issued by any court or other governmental authority of competent jurisdiction prohibiting, rendering illegal or enjoining the consummation of the transactions contemplated by the

Table of Contents

Purchase Agreement, other than the application to such transactions of applicable waiting periods under the HSR Act or other antitrust laws (excluding any antitrust laws under which criminal sanctions would be imposed if the Offer were to be consummated).

The &#;CFIUS Clearance Condition&#; requires (a) the receipt of a written notification issued by the Committee on Foreign Investment in the United States (&#;CFIUS&#;) that it has determined that the transactions contemplated by the Purchase Agreement are not a &#;covered transaction&#; pursuant to 31 C.F.R. and 50 U.S.C. App.

The &#;Termination Condition&#; requires that the Purchase Agreement has not been terminated in accordance with its terms.

The Offer is not subject to a financing condition but is subject to other conditions as described in this Offer to Purchase. See Section 15 &#; &#;Certain Conditions of the Offer.&#;

A summary of the principal terms of the Offer appears under the heading &#;Summary Term Sheet.&#; You should read this entire Offer to Purchase carefully before deciding whether to tender your Shares pursuant to the Offer.

July 29,

Table of Contents

IMPORTANT

If you desire to tender all or any portion of your Shares to Purchaser pursuant to the Offer, you must, prior to the Expiration Time, (a) complete and sign the Letter of Transmittal that accompanies this Offer to Purchase in accordance with the instructions in the Letter of Transmittal and mail or deliver the Letter of Transmittal and all other required documents to American Stock Transfer & Trust Company, LLC, in its capacity as depositary for the Offer (the &#;Depositary&#;), (b) follow the procedure for book-entry transfer described in Section 3 &#; &#;Procedures for Accepting the Offer and Tendering Shares,&#; or (c) request that your broker, dealer, commercial bank, trust company or other nominee to effect the transaction for you. If you hold Shares registered in the name of a broker, dealer, commercial bank, trust company or other nominee, you must contact that institution in order to tender your Shares to Purchaser pursuant to the Offer. If you cannot comply in a timely manner with the procedures for tendering your Shares by book-entry transfer, or you cannot deliver all required documents to the Depositary prior to the Expiration Time, you may tender your Shares to Purchaser pursuant to the Offer by following the procedures for guaranteed delivery described in Section 3 &#; &#;Procedures for Accepting the Offer and Tendering Shares.&#;

Questions and requests for assistance should be directed to Innisfree M&A Incorporated, the information agent for the Offer (the &#;Information Agent&#;) at its address and telephone numbers set forth on the back cover of this Offer to Purchase. Additional copies of this Offer to Purchase, the related Letter of Transmittal, and other materials related to the Offer may also be obtained for free from the Information Agent. Additionally, copies of this Offer to Purchase, the related Letter of Transmittal, the notice of guaranteed delivery and any other material related to the Offer may be obtained at the website maintained by the SEC at www.spearpointsecuritygroup.com. You may also contact your broker, dealer, commercial bank, trust company or other nominee for assistance.

This Offer to Purchase and the Letter of Transmittal contain important information and you should read both carefully and in their entirety before making a decision with respect to the Offer.

The Offer has not been approved or disapproved by the SEC or any state securities commission nor has the SEC or any state securities commission passed upon the fairness or merits of or upon the accuracy or adequacy of the information contained in this Offer to Purchase. Any representation to the contrary is unlawful.

The Information Agent for the Offer is:

Innisfree M&A Incorporated

Madison Avenue, 20th Floor

New York, New York

Shareholders may call toll free: ()

Banks and brokers may call collect: ()

Table of Contents

TABLE OF CONTENTS

Table of Contents

SUMMARY TERM SHEET

The information contained in this summary term sheet is a summary only and is not meant to be a substitute for the more detailed description and information contained in this Offer to Purchase, the related Letter of Transmittal and other related materials. You are urged to read carefully the Offer to Purchase, the Letter of Transmittal and other related materials in their entirety. Parent and Purchaser have included cross-references in this summary term sheet to other sections of the Offer to Purchase where you will find more complete descriptions of the topics mentioned below. The information concerning AVG contained herein and elsewhere in the Offer to Purchase has been provided to Parent and Purchaser by AVG or has been taken from or is based upon publicly available documents or records of AVG on file with the SEC or other public sources at the time of the Offer. Parent and Purchaser have not independently verified the accuracy and completeness of such information. Parent and Purchaser have no knowledge that would indicate that any statements contained herein relating to AVG provided to Parent and Purchaser or taken from or based upon such documents and records filed with the SEC are untrue or incomplete in any material respect.

Securities Sought | All outstanding ordinary shares, with a nominal value of &#; per share, of AVG Technologies N.V. |

Price Offered Per Share | $ in cash, without interest and less applicable withholding taxes or other taxes. |

Scheduled Expiration of Offer | p.m., New York City time, on August 31, , unless the Offer is extended or earlier terminated. See Section 1 &#; &#;Terms of the Offer.&#; |

Purchaser | Avast Software B.V., a private company with limited liability (besloten vennootschap met beperkte aansprakelijkheid) organized under the laws of The Netherlands and a direct wholly owned subsidiary of Avast Holding B.V., a private company with limited liability (besloten vennootschap met beperkte aansprakelijkheid) organized under the laws of The Netherlands. |

Who is offering to buy my Shares?

Avast Software B.V., or Purchaser, a direct wholly owned subsidiary of Avast Holding B.V., or Parent, is offering to purchase for cash all outstanding Shares. Purchaser is a private company with limited liability (besloten vennootschap met beperkte aansprakelijkheid) organized under the laws of The Netherlands.

See the &#;Introduction&#; and Section 8 &#; &#;Certain Information Concerning Parent and Purchaser.&#;

Unless the context indicates otherwise, in this Offer to Purchase, we use the terms &#;us,&#; &#;we&#; and &#;our&#; to refer to Purchaser and, where appropriate, Parent. We use the term &#;Parent&#; to refer to Avast Holding B.V. alone, the term &#;Purchaser&#; to refer to Avast Software B.V. alone and the terms &#;AVG&#; and the &#;Company&#; to refer to AVG Technologies N.V.

What are the classes and amounts of securities sought in the Offer?

We are offering to purchase all outstanding Shares at a purchase price of $ per Share, in cash, without interest and less applicable withholding taxes or other taxes, upon the terms and subject to the conditions set forth in this Offer to Purchase and the Letter of Transmittal.

i

Table of Contents

See the &#;Introduction&#; to this Offer to Purchase and Section 1 &#; &#;Terms of the Offer.&#;

Is there an agreement governing the Offer?

Yes. Parent, Purchaser and AVG have entered into a Purchase Agreement, dated as of July 6, The Purchase Agreement provides, among other things, for the terms and conditions of the Offer, the Subsequent Offering Period, which includes the Minority Exit Offering Period, if applicable, and the Subsequent Reorganization. If the conditions to the Offer are satisfied and we consummate the Offer, we intend to effect the Subsequent Reorganization, subject to the satisfaction of certain conditions, including, among other conditions, in the case of the Asset Sale, the Dissolution and the Liquidation Distribution, the approval of AVG shareholders of such transactions and related matters contemplated by the Purchase Agreement at the EGM.

See Section 11 &#; &#;The Purchase Agreement; Other Agreements,&#; Section 12 &#; &#;Purpose of the Offer; Plans for AVG&#; and Section 15 &#; &#;Certain Conditions of the Offer.&#;

Why are you making the Offer?

We are making the Offer because we want to acquire the entire equity interest in AVG so that we will own and control all of AVG&#;s current business. If the Offer is consummated, we intend to cause AVG to terminate the listing of the Shares on the NYSE. As a result, AVG would cease to be publicly traded. In addition, after the consummation of the Offer we intend to cause the termination of the registration of Shares under Exchange Act as promptly as practicable and expect to take steps to cause the suspension of all of AVG&#;s reporting obligations with the SEC.

Following the Expiration Time, Purchaser intends to provide for the Subsequent Offering Period of at least 10 business days in accordance with Rule 14d under the Exchange Act and in accordance with the Purchase Agreement. The Subsequent Offering Period may be extended by Purchaser in accordance with the Purchase Agreement by the Minority Exit Offering Period of at least seven business days following the announcement that Purchaser or its designee intends to effect the Asset Sale. As promptly as practicable following the closing of the Subsequent Offering Period (which includes the Minority Exit Offering Period, if applicable), Purchaser intends to complete the Subsequent Reorganization. The Subsequent Reorganization will utilize processes available to Purchaser to ensure that (a) Purchaser becomes the owner of all of AVG&#;s business operations from and after the consummation of the Subsequent Reorganization and (b) any AVG shareholders who do not tender their Shares pursuant to the Offer (or during the Subsequent Offering Period, which includes the Minority Exit Offering Period, if applicable) are offered or receive the same consideration for their Shares as those shareholders who tendered their Shares pursuant to the Offer (or during the Subsequent Offering Period, which includes the Minority Exit Offering Period, if applicable), without interest and less applicable withholding taxes (including Dutch dividend withholding tax) or other taxes. As a result of the Subsequent Reorganization, it is anticipated that AVG will be liquidated or become wholly owned by Purchaser.

See Section 12 &#; &#;Purpose of the Offer; Plans for AVG&#; of this Offer to Purchase.

How much are you offering to pay and what is the form of payment? Will I have to pay any fees or commissions?

We are offering to pay $ per Share, in cash, without interest and less applicable withholding taxes or other taxes, upon the terms and subject to the conditions set forth in the Purchase Agreement. If you are the record owner of your Shares and you tender your Shares directly to the Depositary, you will not have to pay brokerage fees, commissions or similar expenses. If you own your Shares through a broker, dealer, commercial bank, trust company or other nominee and your broker, dealer, commercial bank, trust company or other nominee

ii

Table of Contents

tenders your Shares on your behalf, your broker, dealer, commercial bank, trust company or nominee may charge you a fee for doing so. You should consult your broker, dealer, commercial bank, trust company or nominee to determine whether any charges will apply.

See the &#;Introduction,&#; Section 1 &#; &#;Terms of the Offer,&#; and Section 2 &#; &#;Acceptance for Payment and Payment for Shares.&#;

Will you have the financial resources to make payment?

Yes, we anticipate that we will have sufficient resources available to us. The Offer is not subject to a financing condition. We estimate that the total funds required to purchase all of the Shares pursuant to the Offer and to consummate the other transactions contemplated by the Purchase Agreement (which estimate includes, among other things, payment in respect of outstanding in-the-money options and vested and unvested restricted stock units and performance-based restricted stock units), pay related transaction fees and expenses due and payable on or prior to the consummation of the Offer, pay or refinance all Purchaser and AVG debt that is required to be paid or refinanced upon consummation of the Offer and satisfy all other payment obligations of Purchaser and AVG required to be satisfied at the closing of the Offer will be approximately $ billion. Purchaser has obtained commitments from Credit Suisse AG, Jefferies Finance LLC, UBS AG, Stamford Branch, Bank of America Merrill Lynch International Limited and Société Générale (collectively, the &#;Lenders&#;) to provide $ million in a senior secured revolving credit facility with a term of five years (the &#;Revolving Credit Facility&#;) and $1, million equivalent in senior secured term loan facilities (which will be provided as (a) a senior secured term loan facility denominated in U.S. dollars with a term of six years (the &#;Dollar Tranche Term Facility&#;) and (b) a senior secured term loan facility denominated in Euros with a term of six years, such Euro amount determined based on the spot rate of exchange on the date of allocation of commitments of the Term Loan Facilities (as defined below) in connection with primary syndication (the &#;Euro Tranche Term Facility&#; and, the Dollar Tranche Term Facility and Euro Tranche Term Facility, collectively, the &#;Term Loan Facilities,&#; and together with the Revolving Credit Facility, the &#;Debt Financing&#;). Parent and Purchaser anticipate that the Debt Financing and/or bank or other debt financings that may be entered into or issued by Purchaser in lieu of all or a portion of the Debt Financing, together with certain unrestricted cash or cash equivalents available to Purchaser (including such cash or cash equivalents of AVG that will become available to Purchaser upon the consummation of the Offer), will be sufficient to fund the purchase of all the Shares pursuant to the Offer and to pay related transaction fees and expenses due and payable on or prior to the consummation of the Offer, and pay or refinance all Purchaser and AVG debt that is required to be paid or refinanced upon consummation of the Offer, in accordance with the provisions of the Debt Financing, and satisfy all other payment obligations of Purchaser and AVG required to be satisfied upon consummation of the Offer. Credit Suisse AG (acting through such of its affiliates or branches as it deems appropriate) will act as sole and exclusive administrative agent and collateral agent in respect of the Debt Financing. Funding of the Debt Financing is subject to the satisfaction of various conditions set forth in the amended and restated commitment letter pursuant to which the Debt Financing will be provided. The documentation governing the Debt Financing has not been finalized and, accordingly, the actual terms of the Debt Financing may, subject to the prior written consent of AVG in the case of certain changes to the Debt Financing, differ from those described in this document. The parties to the documentation governing the Debt Financing are expected to include Parent, Purchaser, certain subsidiaries of Purchaser, the Lenders and/or their affiliates, and other financial institutions party thereto as lenders.

See Section 9 &#; &#;Source and Amount of Funds&#; and Section 11 &#; &#;The Purchase Agreement; Other Agreements.&#;

iii

Table of Contents

Is your financial condition relevant to my decision to tender my Shares pursuant to the Offer?

No. We do not think our financial condition is relevant to your decision whether to tender Shares and accept the Offer because:

| &#; | the Offer is being made for all outstanding Shares solely for cash; |

| &#; | we have received debt commitments, which, in addition to certain unrestricted cash or cash equivalents available to us, we anticipate will be sufficient to purchase all Shares tendered pursuant to the Offer; |

| &#; | the Offer is not subject to any financing condition; and |

| &#; | if we consummate the Offer and not all outstanding Shares are tendered pursuant to Offer or during the Subsequent Offering Period (which includes the Minority Exit Offering Period, if applicable), we intend to (a) commence the Compulsory Acquisition and offer each non-tendering AVG shareholder (or such AVG shareholder must otherwise receive) the Offer Price (without interest and less applicable withholding taxes or other taxes) for each Share then held by such non-tendering AVG shareholder, or (b) acquire all assets of AVG in the Asset Sale such that non-tendering AVG shareholders will receive the Offer Price (without interest and less applicable withholding taxes (including Dutch dividend withholding tax) or other taxes) as the Liquidation Distribution. |

However, in the Compulsory Acquisition, the Dutch Enterprise Chamber (Ondernemingskamer) of the Amsterdam Court of Appeals (Gerechtshof Amsterdam) (the &#;Dutch Court&#;) will determine the price to be paid for the Shares, which may be greater, equal to or less than the Offer Price.

See Section 5B &#; &#;Certain Dutch Tax Aspects of the Offer and Subsequent Reorganization.&#;

How long do I have to decide whether to tender my Shares pursuant to the Offer?

You will have until p.m., New York City time, on August 31, unless we extend the Offer in accordance with the Purchase Agreement or the Offer is earlier terminated. Furthermore, if you cannot deliver everything that is required in order to make a valid tender in accordance with the terms of the Offer by that time, you may still participate in the Offer by using the guaranteed delivery procedure that is described in Section 3 &#;&#;Procedures for Accepting the Offer and Tendering Shares&#; of this Offer to Purchase prior to that time.

The Purchase Agreement provides, among other things, that, subject to the terms and conditions set forth therein, Purchaser will, promptly after the Expiration Time, accept for payment all Shares validly tendered pursuant to the Offer and not properly withdrawn and, promptly after the Acceptance Time, pay for all such Shares. See Section 1 &#; &#;Terms of the Offer&#; and Section 3 &#; &#;Procedures for Accepting the Offer and Tendering Shares.&#;

Please give your broker, dealer, commercial bank, trust company or other nominee instructions with sufficient time to permit such broker, dealer, commercial bank, trust company or other nominee to tender your Shares. Beneficial owners should be aware that their broker, dealer, commercial bank, trust company or other nominee may establish its own earlier deadline for participation in the Offer. Accordingly, beneficial owners wishing to participate in the Offer should contact their broker, dealer, commercial bank, trust company or other nominee as soon as possible in order to determine the times by which such owner must take action in order to participate in the Offer.

iv

Table of Contents

Can the Offer be extended and under what circumstances?

Yes, subject to our rights to terminate the Purchase Agreement in accordance with its terms, we have agreed in the Purchase Agreement that we will extend the Offer under the following circumstances:

| &#; | if any condition to the Offer is not satisfied or waived at the Expiration Time, we must extend the Offer (the length of such extension period to be determined by Parent or us) from time to time until such condition or conditions to the Offer are satisfied or waived; |

| &#; | we must extend the Offer for any period required by any rule, regulation, interpretation or position of the SEC, the staff thereof or the NYSE applicable to the Offer or as may be required by any other governmental authority; and |

| &#; | if the Marketing Period (as defined in Section 11 &#; &#;The Purchase Agreement; Other Agreements &#;Purchase Agreement&#;) has not ended on the last business day prior to the Expiration Time, we must extend the Offer until the earlier to occur of (a) any business day before or during the Marketing Period as may be specified by Parent or us on no less than two business days&#; prior notice to AVG, and (b) the first business day after the final day of the Marketing Period. |

Additionally, notwithstanding anything in the Purchase Agreement to the contrary, at the Expiration Time, we may extend the Offer for up to 10 business days from the date the Marketing Period will otherwise end.

We are not, however, required to extend the Offer (a) beyond January 6, , (b) for an individual extension period of more than 10 business days or (c) at any time that we are permitted to terminate the Purchase Agreement. If we extend the Offer, such extension will extend the time that you will have to tender (or withdraw) your Shares.

See Section 1 &#; &#;Terms of the Offer.&#;

How will I be notified if the Offer is extended?

Any extension of the Offer will be followed by a public announcement of the extension no later than a.m., New York City time, on the next business day after the day on which the Offer was otherwise scheduled to expire. Without limiting the manner in which Purchaser may choose to make any public announcement, it currently intends to make announcements regarding the Offer by issuing a press release and making any appropriate filing with the SEC.

See Section 1 &#; &#;Terms of the Offer.&#;

Will there be a subsequent offering period?

Yes, following the Expiration Time, Purchaser is obligated by the Purchase Agreement to provide for the Subsequent Offering Period of at least 10 business days in accordance with Rule 14d under the Exchange Act and in accordance with the Purchase Agreement. No withdrawal rights will apply to any Shares tendered during the Subsequent Offering Period. The Subsequent Offering Period may be extended by Purchaser in accordance with the Purchase Agreement by the Minority Exit Offering Period of at least seven business days following the announcement that Purchaser or its designee intends to effect the Asset Sale.

See Section 1 &#; &#;Terms of the Offer.&#;

v

Table of Contents

What are the most significant conditions to the Offer?

The Offer is conditioned upon, among other things, the satisfaction or waiver (to the extent permitted by the Purchase Agreement and applicable law) of the following as of immediately prior to the Expiration Time: (a) the Minimum Condition, (b) the Antitrust Clearance Condition, (c) the Restraints Condition, (d) the CFIUS Clearance Condition and (e) the Termination Condition.

The Offer also is subject to a number of other conditions to the Offer set forth in Section 15 &#; &#;Certain Conditions of the Offer&#; of this Offer to Purchase. The conditions to the Offer will be in addition to, and not a limitation of, the rights of Parent and Purchaser to extend, terminate or modify the Offer in accordance with the terms and conditions of the Purchase Agreement. Subject to the applicable rules and regulations of the SEC, Purchaser expressly reserves the right at any time prior to the Expiration Time to waive, in whole or in part, any condition to the Offer and to make any change in the terms of or conditions to the Offer. However, Purchaser will not (without the prior written consent of AVG): (a) waive or change the Minimum Condition; (b) decrease the Offer Price; (c) change the form of consideration to be paid in the Offer; (d) decrease the number of Shares sought in the Offer; (e) extend or otherwise change the Expiration Time other than in accordance with the Purchase Agreement; or (f) impose additional conditions to the Offer or otherwise amend, modify or supplement any of the conditions to the Offer or terms of the Offer in a manner adverse to AVG shareholders.

See Section 15 &#; &#;Certain Conditions of the Offer.&#;

Have any AVG shareholders agreed to tender their Shares?

Yes, TA X L.P., TA Atlantic and Pacific VI L.P., TA Strategic Partners Fund II L.P., TA Strategic Partners Fund II-A L.P. and TA Investors III L.P., shareholders of AVG that together own approximately percent of the Shares, and CVP II, Inc., that owns approximately percent of the Shares (in each case based on 50,, Shares outstanding as of July 25, ), have entered into tender agreements with Purchaser, dated as of July 6, , pursuant to which each such shareholder has agreed, among other things, to tender all of the Shares held by such shareholder into the Offer. In the tender agreements, the shareholder parties have agreed to vote their Shares to, among other things, approve the Asset Sale, the Dissolution, the Liquidation Distribution, the appointment of directors designated by Purchaser and other matters relating to the transactions contemplated by the Purchase Agreement. Each tender agreement may be terminated by the applicable shareholder party upon the occurrence of certain events, including the termination of the Purchase Agreement.

See Section 11 &#; &#;The Purchase Agreement; Other Agreements &#; Tender Agreements.&#;

How do I tender my Shares?

In order for Shares to be validly tendered pursuant to the Offer, you must follow these instructions:

| &#; | If you are a record holder and you hold uncertificated Shares in book-entry form on the books of AVG&#;s transfer agent, the following must be received by the Depositary at one of its addresses set forth in the Letter of Transmittal before the Offer expires: (a) the Letter of Transmittal, properly completed and duly executed; and (b) any other documents required by the Letter of Transmittal. |

| &#; | If your Shares are held in &#;street&#; name and are being tendered by book-entry transfer, the following must be received by the Depositary at one of its addresses set forth in the Letter of Transmittal before the Offer expires: (a) a Book-Entry Confirmation (as defined under Section 2 &#; &#;Acceptance for Payment and Payment for Shares&#;); (b) the Letter of Transmittal, properly completed and duly executed, or an Agent&#;s Message (as defined under Section 2 &#; &#;Acceptance for Payment and Payment for Shares&#;); and (c) any other documents required by the Letter of Transmittal. |

vi

Table of Contents

| &#; | If you cannot complete the procedure for delivery by book-entry transfer on a timely basis, or you otherwise cannot deliver all required documents to the Depositary before the Offer expires, you may be able to tender your Shares using the enclosed Notice of Guaranteed Delivery. For the tender to be valid, however, the Depositary must receive the Notice of Guaranteed Delivery prior to the Expiration Time and must then receive the missing items within three NYSE trading days after the date of execution of such Notice of Guaranteed Delivery. Please contact the Information Agent for assistance. |

| &#; | If you hold Shares through a broker, dealer, commercial bank, trust company or other nominee, you must contact your broker, dealer, commercial bank, trust company or other nominee and give instructions that your Shares be tendered. |

See Section 3 &#; &#;Procedures for Accepting the Offer and Tendering Shares.&#;

Until what time may I withdraw previously tendered Shares?

You may properly withdraw your previously tendered Shares at any time until the Expiration Time. In addition, pursuant to Section 14(d)(5) of the Exchange Act, Shares may be withdrawn at any time after September 27, , which is the 60th day after the date of the commencement of the Offer, unless prior to that date Purchaser has accepted for payment the Shares validly tendered in the Offer. There will be no withdrawal rights during the Subsequent Offering Period (which includes the Minority Exit Offering Period, if applicable); any Shares tendered will immediately be accepted and promptly paid for.

See Section 4 &#; &#;Withdrawal Rights.&#;

How do I withdraw previously tendered Shares?

To properly withdraw previously tendered Shares, you must deliver a written notice of withdrawal with the required information (as specified in this Offer to Purchase and in the related Letter of Transmittal) to the Depositary at any time at which you have the right to withdraw Shares. If you tendered Shares by giving instructions to a broker, dealer, commercial bank, trust company or other nominee, you must instruct such broker, dealer, commercial bank, trust company or other nominee to arrange for the withdrawal of your Shares and such broker, dealer, commercial bank, trust company or other nominee must effectively withdraw such Shares at any time at which you have the right to withdraw your Shares.

See Section 4 &#; &#;Withdrawal Rights.&#;

What do the AVG Supervisory Board and the AVG Management Board think of the Offer?

After due and careful discussion and consideration, including a thorough review of the Offer with their outside legal and financial advisors, the AVG Boards by unanimous vote of all directors present or represented and voting (a) approved the terms of, and the transactions contemplated by, the AVG Transaction Documents, and approved AVG&#;s entry into the AVG Transaction Documents; and (b) determined to support the Offer and to recommend that AVG shareholders accept the Offer, subject to the terms and conditions of the AVG Transaction Documents. The AVG Boards also unanimously approved (i) the Asset Sale, the subsequent Dissolution and the Liquidation Distribution and the appointment of a liquidator; (ii) the terms and conditions of the Asset Sale Agreement and the entry into the Asset Sale Agreement by AVG upon Purchaser&#;s request as set forth in the AVG Transaction Documents; and (iii) the proposed amendment of the articles of association of AVG if the Asset Sale is pursued and the proposed amendment of the articles of association of AVG and conversion of AVG into a private company with limited liability if the Asset Sale is not pursued.

vii

Table of Contents

The AVG Boards unanimously support the Offer and recommend that AVG shareholders accept the Offer. The AVG Boards unanimously recommend that you vote &#;for&#; each of the items that contemplate a vote of AVG shareholders at the EGM. At the EGM, AVG shareholders will be requested to vote on the Asset Sale, the Dissolution, the Liquidation Distribution, the appointment of the liquidator, the appointment of directors designated by Purchaser to the AVG Boards and other matters contemplated by the Purchase Agreement.

A more complete description of the reasons that AVG Boards approved the Offer and recommended that shareholders accept the Offer and tender their Shares pursuant to the Offer is set forth in the Solicitation/Recommendation Statement on Schedule 14D-9 of AVG that AVG is furnishing to shareholders in connection with the Offer.

If I decide not to tender, how will the Offer affect my Shares?

We anticipate that, after the consummation of the Offer, there may be so few remaining shareholders and publicly-held Shares that the Shares will no longer be eligible to be traded on the NYSE or any other securities exchange. After the consummation of the Offer, we intend to cause AVG to terminate the listing of the Shares on the NYSE. As a result, we anticipate that there will not be an active trading market for the Shares. In addition, after the consummation of the Offer we intend to cause AVG to terminate the registration of Shares under the Exchange Act as promptly as practicable and take steps to cause the suspension of its reporting obligations with the SEC. As a result, AVG would no longer be required to make filings with the SEC or otherwise comply with the rules of the SEC relating to publicly-held companies. Furthermore, the ability of &#;affiliates&#; of AVG and persons holding &#;restricted securities&#; of AVG to dispose of such securities pursuant to Rule promulgated under the Securities Act of (as amended, and together with the rules and regulations promulgated thereunder, the &#;Securities Act&#;), may be impaired or eliminated.

If a Subsequent Reorganization is consummated, it is anticipated that AVG shareholders who do not tender their Shares pursuant to the Offer (or during the Subsequent Offering Period, which includes the Minority Exit Offering Period, if applicable) will be offered or will receive the same consideration for their Shares as those shareholders who tendered their Shares pursuant to the Offer (or during the Subsequent Offering Period, which includes the Minority Exit Offering Period, if applicable), without interest and less applicable withholding taxes (including Dutch dividend withholding tax) or other taxes. However, in the Compulsory Acquisition, the Dutch Court will determine the price to be paid for the Shares, which may be greater, equal to or less than the Offer Price.

As a result of the Subsequent Reorganization, it is anticipated that AVG will be liquidated or become wholly owned by Purchaser. In addition, if the Offer and the Subsequent Reorganization are completed, another difference to you between tendering your Shares and not tendering your Shares pursuant to the Offer is that you may be paid earlier if you tender your Shares pursuant to the Offer.

The applicable withholding taxes (including Dutch dividend withholding tax) or other taxes, if any, imposed on AVG shareholders who do not tender their Shares pursuant to the Offer (or during the Subsequent Offering Period, which includes the Minority Exit Offering Period, if applicable) are likely to be different from, and greater than, the taxes imposed upon such AVG shareholders had they tendered their Shares pursuant to the Offer (or during the Subsequent Offering Period, which includes the Minority Exit Offering Period, if applicable). If in connection with the Asset Sale and the Subsequent Reorganization it is decided that AVG will be dissolved and liquidated, Dutch dividend withholding tax will (unless a shareholder qualifies for an exemption or reduction) be due at the statutory rate of 15 percent to the extent that the liquidation proceeds exceed the average paid-in capital of those Shares as recognized for purposes of Dutch dividend withholding tax purposes. As a result, the net amount received by AVG shareholders for Shares that are not tendered in the Offer is likely to be lower than the amount that they would have received had they tendered their Shares pursuant to the Offer (or during the

viii

Table of Contents

Subsequent Offering Period, which includes the Minority Exit Offering Period, if applicable). The amount received will depend upon each AVG shareholder&#;s individual corporate income tax or personal income tax circumstances and the amount of any required withholding or other taxes.

See the &#;Introduction&#; to this Offer to Purchase, Section 11 &#; &#;The Purchase Agreement; Other Agreements,&#; Section 12 &#; &#;Purpose of the Offer; Plans for AVG&#; and Section 13 &#; &#;Certain Effects of the Offer.&#;

What is the market value of my Shares as of a recent date?

On July 6, , the trading day before the public announcement of the terms of the Offer, the reported closing sales price of the Shares on the NYSE was $ On July 28, , the last full trading day before the commencement of the Offer, the reported closing sales price of the Shares on the NYSE was $ The Offer Price represents an approximately 33 percent premium over the July 6, closing stock price, and an approximately 1 percent premium over the July 28, stock price.

See Section 6 &#; &#;Price Range of Shares; Dividends.&#;

Will I have appraisal rights in connection with the Offer?

The AVG shareholders are not entitled under Dutch law or otherwise to appraisal rights with respect to the Offer. However, in the event that upon the Expiration Time or after the Subsequent Offering Period (which includes the Minority Exit Offering Period, if applicable), Purchaser holds 95 percent or more of the then outstanding Shares, Purchaser may acquire the remaining Shares not tendered and purchased by means of the Compulsory Acquisition. In such proceedings the Dutch Court will determine the cash price to be paid for the Shares, which may be greater than, equal to or less than the Offer Price. The non-tendering AVG shareholders do not have the right to oblige the Purchaser to buy their Shares.

See Section 17 &#; &#;Appraisal Rights.&#;

What will happen to my equity awards in the Offer?

At the Acceptance Time, each option to purchase Shares granted under the stock plans of AVG, including the Amended and Restated Option Plan and the Appendix to the Amended and Restated Option Plan &#; RSU Plan (collectively, the &#;AVG Stock Plan&#;) (such option, an &#;AVG Option&#;), whether vested or unvested, that is outstanding as of immediately prior to the Acceptance Time will be cancelled and extinguished without any further action on the part of Purchaser, AVG, or any holder of an AVG Option or any other person. To the extent that an AVG Option is vested as of the Acceptance Time (as determined in accordance with the terms of the AVG Stock Plan and the applicable award agreement) and has an exercise price per Share that is less than the Offer Price, at the Acceptance Time, such vested AVG Option will be converted into the right to receive a cash payment from Parent at the Acceptance Time (less applicable withholding taxes or other taxes) equal to the product of (a) the excess, if any, of the Offer Price over the applicable per Share exercise price of such AVG Option multiplied by (b) the number of vested Shares subject to such AVG Option. An AVG Option that is unvested as of the Acceptance Time or has an exercise price per Share that is equal to or greater than the Offer Price will be cancelled without any cash or other consideration being paid or provided therefor, except that if, as of the date of the Purchase Agreement, with respect to certain AVG Options specifically identified on the confidential disclosure schedule that AVG delivered to Parent and Purchaser concurrently with the execution of the Purchase Agreement which contain a vesting acceleration provision that can be triggered following the Acceptance Time upon a qualifying event or termination of employment, then upon the satisfaction of all of the conditions otherwise necessary for such vesting acceleration in accordance with the existing rights of the holder

ix

Table of Contents

of such AVG Option, Parent will, within 30 days after the date of the qualifying event or termination triggering the vesting acceleration, provide the holder of such AVG Option with a payment (less applicable withholding taxes or other taxes) equal to the product of (i) the excess, if any, of the Offer Price over the applicable per Share exercise price of such AVG Option multiplied by (ii) the number of Shares subject to such AVG Option that would have vested had the AVG Option been outstanding on the date of the event triggering the vesting acceleration right with respect to such AVG Option. No interest will be paid or accrued on any cash payable with respect to any AVG Option.

At the Acceptance Time, and without any further action on the part of Purchaser, AVG, or any holder of any outstanding performance-based restricted stock unit (an &#;AVG Performance Stock Unit&#;) or outstanding restricted stock unit (an &#;AVG Restricted Stock Unit&#;) or any other person, each AVG Performance Stock Unit or AVG Restricted Stock Unit that is vested as of the Acceptance Time (as determined in accordance with the terms of the AVG Stock Plan and the applicable award agreement) will no longer be outstanding and will automatically be cancelled and converted into the right to receive an amount in cash from Parent at the Acceptance Time (less applicable withholding taxes or other taxes) equal to the product of (a) the Offer Price multiplied by (b) the number of vested Shares subject to such AVG Performance Stock Unit or AVG Restricted Stock Unit. No interest will be paid or accrued on any cash payable with respect to any vested AVG Performance Stock Unit or AVG Restricted Stock Unit.

See Section 11 &#; &#;The Purchase Agreement; Other Agreements &#; Purchase Agreement &#; Treatment of Equity Awards.&#;

What are the material U.S. federal income tax consequences of tendering Shares for U.S. shareholders?

The receipt of cash in exchange for your Shares pursuant to the Offer (or during the Subsequent Offering Period, which includes the Minority Exit Offering Period, if applicable) (together for purposes of U.S. federal income tax discussions, the &#;Offer&#;) or the Subsequent Reorganization generally will be a taxable transaction for U.S. federal income tax purposes and may also be a taxable transaction under applicable state, local or non-U.S. income or other tax laws.

We urge you to consult your own tax advisor as to the particular tax consequences to you of the Offer and the Subsequent Reorganization.

See Section 5A &#; &#;Certain Material U.S. Federal Income Tax Consequences&#; for a more detailed discussion of the U.S. federal income tax consequences of the Offer, the Asset Sale and the Subsequent Reorganization for certain U.S. shareholders.

x

Table of Contents

What are the material Dutch tax consequences of having my Shares accepted for payment in the Offer?

For non-Dutch resident AVG shareholders who or that:

| (a) | do not have, nor are deemed not to have, directly or indirectly, a substantial interest (aanmerkelijk belang)or deemed substantial interest (fictief aanmerkelijk belang) in AVG; |

| (b) | in the case of non-Dutch resident AVG shareholders that are not individuals, (i) do not derive profits from an enterprise that is, in whole or in part, carried on through a permanent establishment or a permanent representative in The Netherlands to which permanent establishment or permanent representative the Shares are attributable, or (ii) are not, other than by way of securities, entitled to a share in the profits of an enterprise or a co-entitlement to the net worth of an enterprise, which is effectively managed in The Netherlands and to which enterprise the Shares are attributable; |

What’s New in the avg 2016 Archives?

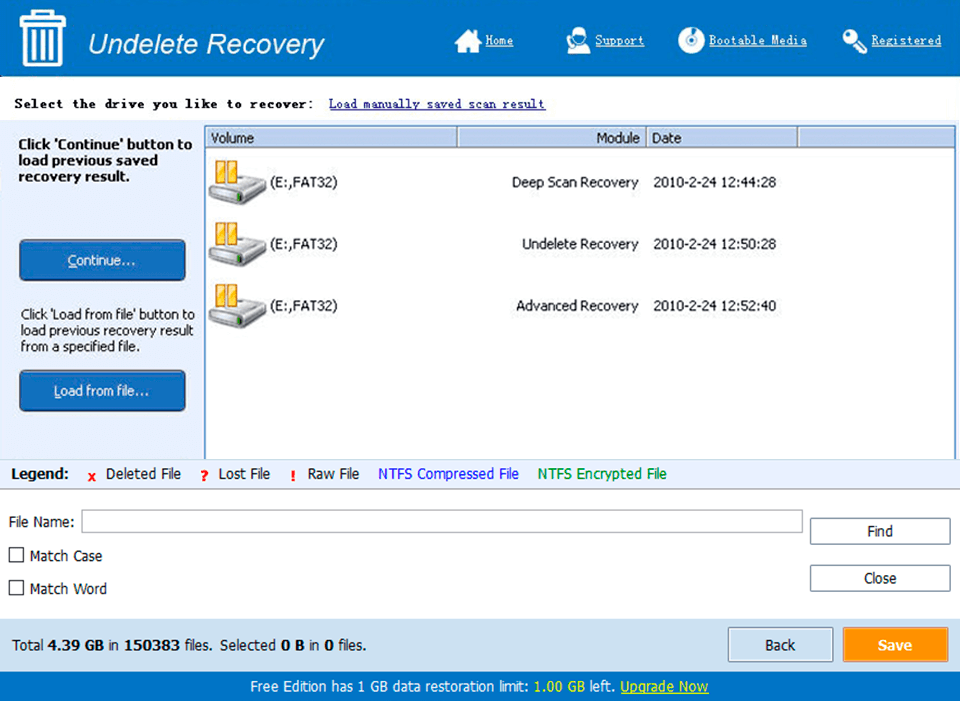

Screen Shot

System Requirements for Avg 2016 Archives

- First, download the Avg 2016 Archives

-

You can download its setup from given links: