July 2020

July 2020

August 10, 2020 – ALROSA reports its diamond sales results for July and seven months of 2020.

Sales of rough and polished diamonds in July amounted to $35.8 million, including proceeds from rough diamond sales of $22.7 million, and polished diamond sales of $13.2 million.

For seven months of 2020, total rough and polished diamond sales accounted for $1,027 million, including $978.0 million of rough diamond sales and $49.0 million of polished.

‘Given the situation in the diamond value chain is challenging, specifically at the midstream, we kept supporting with the unprecedented measures our long-term clients, offering them an opportunity to refrain from buying contracted volumes of rough in July. Furthermore, we decided, as a measure of support amidst extremely challenging market conditions, to provide our clients with an additional flexibility. Nevertheless, we see the market's interest in expensive goods, such as special size and large diamonds of high color and quality characteristics. In July, we successfully auctioned +10.8 carats’ diamonds in Israel and Belgium. We also sold expensive rough on spot. As a result, the average realized price of gem-quality diamonds in July increased by 9x compared this year's average. As for the terms of the August trading session and the possibility of offering our clients an option to defer purchases, the decision has not been taken yet,’ ALROSA Deputy CEO Evgeny Agureev commented. He noted that the company would continue doing everything needed to reach the market supply and demand balance as soon as possible.

ALROSA Group rough and polished diamond sales in 2020

Calendar

(Press release is to be published at 13:30 Moscow time)

(Press release is to be published at 13:30 Moscow time)

(Press conference is to start at 15:00 Moscow time)

(Press release is to be published at 13:30 Moscow time)

(Press release is to be published at 13:30 Moscow time)

(Press conference is to start at 15:00 Moscow time)

(Press release is to be published at 13:30 Moscow time)

(Press release is to be published at 13:30 Moscow time)

(Press conference is to start at 15:00 Moscow time)

(Press release is to be published at 13:30 Moscow time)

(Press release is to be published at 13:30 Moscow time)

(Press conference is to start at 15:00 Moscow time)

VTB Group announces IFRS financial results for July and 7M 2020

VTB Bank, the parent company of VTB Group (the “Group”), today publishes its unaudited consolidated financial results in accordance with IFRS for July and seven months of 2020.

Andrey Kostin, President and Chairman of the Management Board of VTB Bank, said: "In July, we continued to achieve solid growth in business volumes and core revenues like interest and fee & commission income. However, the repercussions of the sharp decline in business activity caused by the COVID-19 pandemic in July, as well as in 2Q 2020, drove up provisions and put pressure on the Group’s overall profitability.

"VTB’s net profit for seven months of 2020 amounted to RUB 43.0 billion, which corresponds to a return on equity of 4.3%. In light of this, the Supervisory Board decided to recommend that the Annual General Meeting of Shareholders approve dividend payments for 2019 in the amount of RUB 20.1 billion, which will enable us to maintain the required capital adequacy levels and ensure business growth against the backdrop of decreasing profitability.

“VTB’s key priority until the end of the year is to build up provisions on the basis of a conservative assessment of the economic situation, while actively expanding the client base, curbing costs growth and pushing ahead with technological transformation. This will create a solid foundation to improve financial performance and deliver on our goals.”

The Group achieved strong business growth in 7M 2020 despite the impact of the COVID-19 pandemic

- Loans and advances to customers (hereinafter before provisions) amounted to RUB 12.5 trillion as of 31 July 2020, up 9.1% since the beginning of the year; adjusted for the effect of currency revaluation, the increase was 4.3%. In July 2020, the total loan portfolio increased by 4.7%; adjusted for the effect of currency revaluation, the increase was 2.9%.

- Loans to individuals increased by 1.5% in July to RUB 3.7 trillion (29% of the total loan portfolio); adjusted for the effect of currency revaluation, the increase was 1.4%. Loans to individuals increased by 8.6% from the beginning of the year; adjusted for the effect of currency revaluation, the increase was 8.2%. Mortgage lending continued to grow at a faster pace, with the mortgage loan portfolio increasing by 1.8% in July and by 12.8% for 7M 2020.

- Loans to legal entities increased by 6.0% in July; adjusted for the effect of currency revaluation, loans to legal entities increased by 3.6%. In total, loans to legal entities increased by 9.3% in 7M 2020 and amounted to RUB 8.9 trillion as of 31 July 2020; adjusted for the effect of currency revaluation, the increase was 2.7%.

- VTB Group’s share of corporate and retail lending in Russia stood at 17.6% and 18.0%, respectively.

- As of 31 July 2020, customer funding totalled RUB 12.1 trillion. In July 2020, total customer funding increased by 2.2%; adjusted for the effect of currency revaluation, customer funding increased by 0.4%. Since the beginning of the year, customer funding has grown by 10.3%; adjusted for the effect of currency revaluation, the increase was 4.3%.

- Funding from legal entities increased by 2.1% in July; adjusted for the effect of currency revaluation, funding from legal entities increased by 0.6%. Since the beginning of the year, funding from legal entities has increased by 13.3% and amounted to RUB 6.7 trillion as of 31 July 2020; adjusted for the effect of currency revaluation, the increase was 7.8%.

- Funding from individuals increased by 2.2% in July; adjusted for the effect of currency revaluation, funding from individuals increased by 0.2%. Since the beginning of the year, funding from individuals has increased by 6.8%, amounting to RUB 5.4 trillion as of 31 July 2020; adjusted for the effect of currency revaluation, the increase was 0.2%.

- The share of customer funding in the Group’s total liabilities increased in 7M 2020 to 79.6% (79.2% as of 31 December 2019). VTB Group’s market share in corporate and retail funding in Russia amounted to 20.5% and 14.9%, respectively.

- As a result of the faster growth in customer funding, the loans to deposits ratio (LDR) decreased to 96.1% as of 31 July 2020 (98.2% as of 31 December 2019).

Profitability metrics were under pressure in the context of the COVID-19 pandemic against a backdrop of higher provisions and a revaluation of investment properties, while core banking income continued to grow steadily

- VTB Group’s net profit amounted to RUB 43.0 billion and RUB 1.1 billion, decreasing by 55.8% and 94.6% year-on-year, respectively, in 7M and July 2020.

- Net interest income was RUB 297.4 billion for 7M 2020 and RUB 45.4 billion in July 2020, up 18.2% and 19.5% year-on-year, respectively.

- Net interest margin was 3.8% for 7M 2020 and in July 2020 (an increase of 50 bps and 40 bps year-on-year, respectively). The net interest margin has risen amid the easing of monetary policy and the fast-paced revaluation of liabilities.

- Despite the pressure caused by the decrease in business activity, net fee and commission income showed strong organic growth and amounted to RUB 63.8 billion for 7M (up 21.5% year-on-year) and RUB 10.9 billion in July 2020 (up 43.4% year-on-year). The increase in net fee and commission income was driven mainly by robust growth in commissions on trade finance and steadily increasing commissions from the sale of insurance products.

- The cost of risk was 2.2% for 7M 2020 and 4.9% in July 2020, up from 0.8% and 0.5% year-on-year, respectively. Provision charges amounted to RUB 162.6 billion for 7M 2020 and RUB 48.7 billion in July 2020, increases of 218.2% and 754.4% year-on-year, respectively.

- The allowance for loan impairments was 6.9% of the total loan book (before provisions) as of 31 July 2020, an increase of 20 bps in July and 90 bps since the beginning of the year.

- The non-performing loans (NPL) ratio was 5.0% as of 31 July 2020 (up 30 bps since the beginning of the year). The NPL coverage ratio was 136.5% as of 31 July 2020 (128.7% as of 31 December 2019 and 131.7% as of 30 June 2020).

- Staff costs and administrative expenses amounted to RUB 150.2 billion for 7M 2020 and RUB 21.1 billion in July 2020, increases of 3.7% and 9.9% year-on-year, respectively. Due to the higher pace of growth in operating income in 7M 2020, the cost-to-income ratio improved to 41.6%, compared with 45.3% a year earlier.

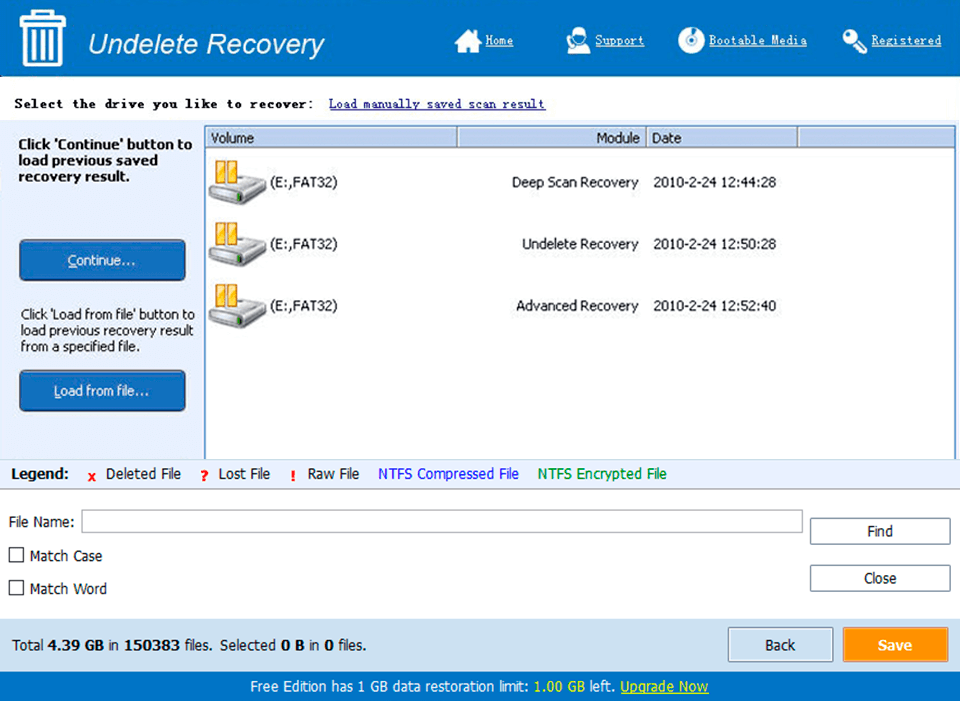

What’s New in the July 2020?

Screen Shot

System Requirements for July 2020

- First, download the July 2020

-

You can download its setup from given links: