Amibroker full version Archives

amibroker full version Archives

Amibroker Software Review, Demo, Download Instructions

You may find different articles on Technical analysis and trading terminals on our site. Most of the trading terminals provide extra benefit for technical analysis. So, for obvious reason, there is always a prominent gap between a professional and a normal charting platform. For example, suppose you love cycling, you will definitely find a prominent difference between a local brand cycle and an advanced featured latest sports cycle. Here also, Amibroker or in short form AB individually a professional charting platform, more advanced than any random trading charting terminals. It is a highly paid software, used for advanced technical analysis. If you are a technical analyst, we will make your route quite easier through this article. Here, you can find Amibroker Software Review, Demo, Download Instructions.

First, you need to understand why we choose AB only. There are numerous professional charting platforms available in the market but Amibroker is considered as one of the best Technical analysis tools in the world. The explanation behind the statement is given below step by step. So, let’s begin.

What is Amibroker?

Amibroker is the most powerful and ultra-fast technical analysis program. The advanced analytics platform provides full-featured exploration tools which help traders to make a huge profit and stay ahead of the crowd. It consists of real-time charting, strong back-testing tool, scanning and many more features which allow traders to trade successfully in every way.

Amibroker Software Review (Updated Features Lists)

In the share market, there is no limit on up-gradation. Those who have more data are always one step ahead in the profit-making ladder. So, you can upgrade your trading to the next level by using this software. Let’s have a look at Amibroker software review.

Powerful Charting and Drawing Tools

This is the most important point in Amibroker software review. It has standard and accurate chart style along with the features of drawing tools. As per traders preference, customization, combined and overlaid options are there. Apart from the advance customization option, multi-time frame present in the chart. More than a hundred popular builds in indicators such as RSI, MACD, Stochastics, ADX, etc are the strength of the charging system.

Analytical Window

Another special feature of Amibroker is its analytical window. The window is considered as a home to optimization, Monte Carlo simulation, walk-forward testing, and backtesting. Cross-correlation among different symbols is present there. Traders can explore the charting platform in many ways.

Scanning and Exploration

Analytical window comprised of both scanner and exploration. These are the real-time screening tools and one of the most useful features. You can screen stocks by BUY, SELL, SHORT, COVER conditions. Exploration is used mainly to screen stocks by generic filter conditions. Besides this, in exploration tool, multiple customs are available.

Monte Carlo Simulation

No one can predict the market with 100% surety. Therefore, traders must be prepared for the worst scenario. The Monte Carlo Simulation check trades’ probabilities in the difficult market condition and peeks the possible results.

3D Optimization Chart

3D optimization chart helps to find out parameter combination which can develop the best and most reliable result. Here, also customization option, rotation, animation, an angle watch are available.

Gradient Chart and Market Profile

Here, charts are displayed as a gradient chart. On the extreme left side, there is a volume-at-price chart. It allows traders to identify price levels with the highest trading volume.

Optimum Parameter Value

Finding out best-performing stocks can be difficult for many of the traders. So, to search for huge spaces in limited time, one can use Amibroker’s smart artificial intelligence optimization.

Ranking and Scoring

Depending on the positioned score, the software performs bar to bar analysis. If multiple signals occur on a single bar during the run out of buying power, Amibroker performs bar-by-bar ranking (based on user-definable position score).

Easy to Develop Own Formulas

In Amibroker either one can use a drag-and-drop interface or apply own formula. Though the first method is quite simple and straightforward, many technical analysts like to choose the second one. The formula language is termed as AFL (Amibroker Formula Language). In order to create your own custom indicator, you need to learn some simple formulas or code. If you go step by step. these codes are not too difficult to understand. To learn the coding is important, as it can be used for trading system design, optimization, exploration, scanning, and back-testing.

AFL (Amibroker Formula Language)

From version 3.0, they introduced AFL. It allows traders to customize indicators, trading design, scanning, back-testing, commentaries. Now, let’s have a quick look at the four most popular AFL, these are Intraday AFL, Rocket Jet AFL, Trader Pro AFL, Buy Sell Signal AFL.

What are the Services Amibroker Offer to its Customers?

Besides the above features, Amibroker has multiple services. We are describing them below:

- Amiquote Data: The quality of data is high enough in all segment of the market (equity, commodity, Futures, Options, Currency). Timings presentation is accurate. You can get Amiquote data from Amibroker.

- Customer Support: It’s online technical support system carries an excellent rating. The support line also remains open in all the five working days.

- Amibroker AFL’s: One can customize and create his own formula by using AFL (Amibroker Formula Language).

- Members Area: Amibroker members area is only available for those who have purchased the software from the official site.

For your knowledge purpose next, we are going to provide updated features of Amibroker 6.0. Here is the list.

Amibroker Demo for Version 6.0 (What’s New in It?)

- There is an integrated high-performance Monte Carlo simulator. This has cumulative distribution charts of equity, max drawdowns, support for custom user-definable metrics. It has the ability to perform MC simulator driven optimizations.

- Full Matrix support (two-dimensional arrays) in AFL with direct native matrix arithmetic (matrix operations such as addition, subtraction, multiplication, division, transpose, etc). You can see Matrix, MxIdentity, MxTranspose, Mx GetSize

- Detailed data of Buy-and-hold (benchmark) statistics automatically added to the backtest reports.

- User defined stop precedence (SetStopPrecedence function) and also stop validity (ValidFrom/ValidTo parameters in ApplyStop function)

- Sparse array support: that is SparseCompress and SparseExpand

- It has Infinite Impulse Response filter function (IIR) for efficient implementation of higher-order smoothing algorithms

- Raw text output in explorations via AddRow function also there.

- New styles which are supported by Exploration XYCharts

- Variable period Percentile functions are present.

- Unicode (UCN) support in PlotText, PlotTextSetFont, GfxDrawText, GfxTextOut, chart titles, interpretations and commentary windows ( which allows various graphics annotations / windings )

- New Low-level graphics functions also present.

To get the Amibroker 6 PDF guide, Click on the link here.

Why You Should Not Use Amibroker Crack Version?

As this is mainly an Amibroker software review, we expect users to be cautious while using a crack version. For obvious reasons, there are some disadvantages to the crack version. Here, is the list:

- Crack version may cause a sudden crash or license error.

- Users can’t get all the features with the crack version.

- If all users begin to use the crack version, then Amibroker will stop updating.

- Crack version will not get any official support from the Amibroker service.

- Users who use crack version of Amibroker will not get FREE Amiquote data while license users can get it at Free of cost.

Amibroker Download Instructions

You may go to the official website to get the download link. This is the most authentic site to download it.

As you can see in the above information that Amibroker 6.30 is available to registered customers only. Amibroker 6.00 can be downloaded by registered as well as non-registered users. Two editions are there, professional and standard editions. With the installation, you will get add-on programs like Amiquote, AFL code Wizard, you don’t need to be download separately.

Trading Systems in Amibroker

There are various trading systems in Amibroker. If you want to know about the systems, you may check our Trend Blaster Trading systems.

AmiBroker FAQ

AmiBroker is the world’s renowned charting and trading platform. It is mainly used worldwide for charting and trading system development. It is also very helpful in backtesting a trading system. However, in some cases, traders can attach it to their broker’s platform for automated trading.

There are 3 versions of the software. The standard edition costs $279, the professional edition costs $339 and the ultimate pack pro costs $499. All these purchases contain 24 months of free upgrade and support.

AmiBroker is highly popular among stock market traders all over the world due to its ease of use. It is a simple and lightweight software than MetaStock. The data charges are also much less as compared to MetaStock. Overall it is a value for money.

Right now no one is authorized to resell AmiBroker in India. So Indian traders also need to purchase it from the official website. So Indians need to pay $279 for the standard edition, $339 for the professional edition and $499 for the ultimate pack pro.

AFL stands for AmiBroker formula language. With the help of this language, one can code their trading logics into a full-fledged trading system. AFL is easy to learn and easy to write. For traders with little or no coding knowledge, there is a simple AFL code wizard.

No, it does not work. This is a windows software and does not have an apple mac version. But there is a simple hack. Mac users can use utilities like parallels desktop to run windows applications on Mac. Using this hack they can also run AmiBroker on their MAC system.

You can add NSE stocks in AmiBroker in 2 ways. Either download NSE stocks data using built-in utilities like AmiQuote. Or you can purchase third party data for NSE symbols and add them to your favorite charting platform.

AmiBroker Professional Edition 6.20.1 x86

Description

AmiBroker is a popular software for technical analysis of financial markets. Success in investing in stock markets and financial markets is based on two important factors of knowledge and information that the program brings together the two factors together. The most widely used program is the stock exchange, both international and financial markets such as Forex and Tehran Stock Exchange. The only thing the program needs is basic information and data that, by entering this data, the software will practically become a technical analysis station and a skilled consultant in the stock market.

The program plays a major role in financial decision making with live price charts and the ability to predict market conditions based on prices and other factors. You can easily focus on your favorite indicators and monitor their growth or decline with great care. In this program you can define alarms according to different conditions in order to inform the user when prices are higher or lower. Chart Engine This software allows you to analyze and edit data much easier than the charts on the Tehran Stock Exchange website.

You can filter out unnecessary parts to focus only on changes to your favorite indexes. One of the interesting features of Ami Broker is its smart adaptation to your needs and goals. In fact, you can see companies that have the potential to fit your strategies by defining the strategies and quantifying the desired number of times in a short period of time. The speed of data analysis in this program is very high and you won’t have any annoying delays. The graphical interface of the program is also very simple and beautifully designed to make it easier for users to interact with the program.

Required system

AmiBroker Hardware requirements

To run AmiBroker you need PC-Compatible computer meeting following minimum requirements

- Pentium 450 MHz or higher

- 128 MB RAM

- 20 MB hard disk space

- 256 color graphics card (high color recommended) 800×600 minimum screen resolution

Recommended machine configuration

- CPU: 1GHz or more, multiple cores

- 512 MB RAM or more

Supported operating systems

AmiBroker works on the following operating systems:

- Windows 10 (any edition) 32-bit

- Windows 10 (any edition) 64-bit

- Windows 8 (any edition) 32-bit

- Windows 8 (any edition) 64-bit

- Windows 7 (any edition) 32-bit

- Windows 7 (any edition) 64-bit

- Windows Vista (any edition) 32-bit

- Windows Vista (any edition) 64-bit

- Windows Server 2008 (any edition) 32-bit

- Windows Server 2008 (any edition) 64-bit

- Windows Server 2008 R2 (any edition) 64-bit

- Windows XP (any edition)

- Windows XP x64 (64-bit)

- Windows 2000 (any edition)

- Windows NT 4.0 SP 3 (or higher) + Internet Explorer 4.0 or higher installed

- Windows Millenium

- Windows 98/98SE/95osr2/95

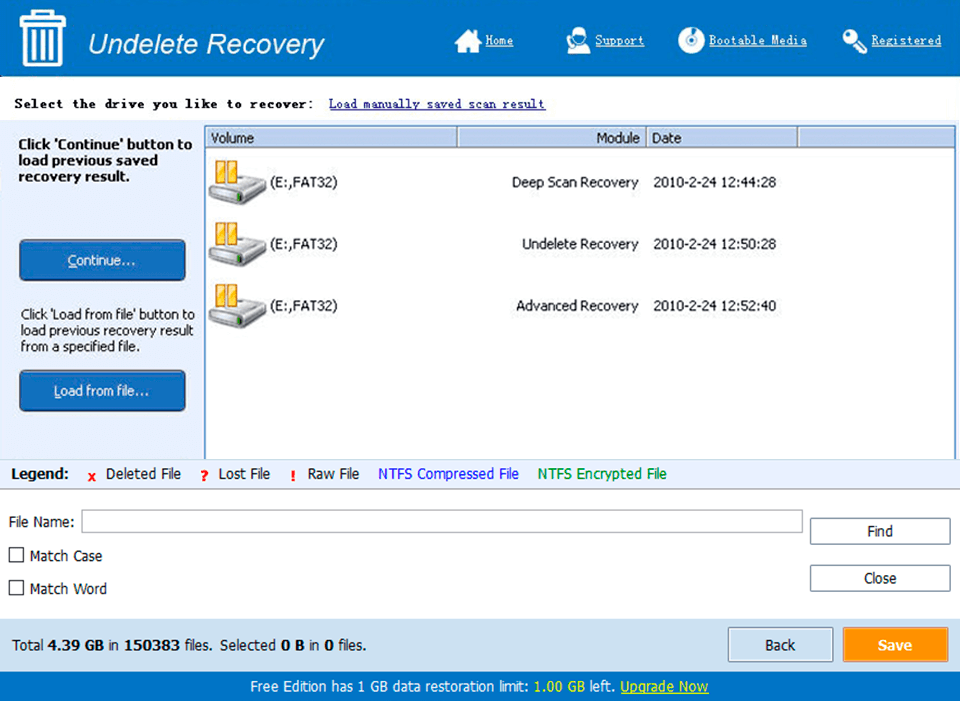

Pictures

AmiBroker

Installation guide

After installation, copy the files in the Crack folder where the software is installed.

Download

[su_table style=”default”]

| File Name | Size | Link |

|---|---|---|

| AmiBroker Professional Edition 6.20.1 x86 | 10.3 MB | Download |

[/su_table]

Password: www.ShareAppsCrack.com

amibroker

By Joe Marwood6 Comments

Five New Trading Systems Revealed

The new course Hedge Fund Trading Systems Part Two is now open for enrolment. This course contains five new trading systems that I have developed. Each system has been run on robust historical data and shows a consistent, profitable edge in back-testing. The rules for each system are fully explained and the Amibroker source code […]

Filed Under: Amibroker, Stocks, Strategies/ SystemsTagged With: amibroker, trading systems

By Joe Marwood7 Comments

Implementing The All Weather Portfolio With ETFs

In this article I implement Ray Dalio’s All Weather portfolio using popular ETFs and I back-test the strategy using Amibroker. The results show nice risk-adjusted returns for investors.

Filed Under: Amibroker, Investing, Strategies/ SystemsTagged With: amibroker, investing

By Joe Marwood4 Comments

The System Traders Feedback Loop – Don’t Get Stuck In The Back-Testing Spiral

Whatever your opinions are about the concept of back-testing, there are few better ways to build a trading system than through the back-testing of historical data. Back-testing allows us to answer critical questions like ‘how many positions should I hold in a portfolio?’, ‘how much risk should I take?’ or ‘how effective was this strategy in the past?’

Filed Under: Amibroker, How to, Strategies/ Systems, Top PostsTagged With: amibroker, trading systems

By Joe Marwood2 Comments

Testing Some Ideas In Amibroker – Overnight Returns In Stocks

All system developers and traders should keep a notepad on their desk so that they can write down their ideas and keep a record of any back-testing that they do. I don’t know what it is, but there is something about writing down on pad and paper that engages the mind far more so than […]

Filed Under: Amibroker, Latest, Stocks, Strategies/ SystemsTagged With: amibroker, latest

By Joe Marwood3 Comments

A Risky Strategy For Shorting Leveraged ETFs

In this article I present a simple and quick trading strategy for shorting leveraged ETFs. Using historical data from Norgate and the back-testing program from Amibroker I reveal a potentially profitable strategy that could benefit from further development.

Filed Under: Amibroker, Latest, Strategies/ SystemsTagged With: amibroker, etfs, latest, strategies, trading systems

By Joe MarwoodLeave a Comment

How To Improve Your Trading System With The Kelly Formula

It has long been established that the Kelly Formula provides a powerful equation for calculating the optimum level of risk with which to place a bet in a probabilistic type game. A game like blackjack or sports betting.

Filed Under: Amibroker, Strategies/ SystemsTagged With: amibroker, kelly, trading systems

By Joe MarwoodLeave a Comment

Using Norgate Data Updater (NDU) – The New Platform

Update 6/6/2018 Norgate Data latest version has now been officially released. This includes the NDU software and historical constituents databases. This is a great service that I use for all my backtesting in Amibroker. More details are available at the Norgate Data website. —-

Filed Under: Amibroker, Latest, UpdateTagged With: amibroker, data, norgate

By Joe Marwood6 Comments

How To Combine Equity Curves In Amibroker And Improve Trading System Performance

One of the keys to successful system trading is to be able to combine different strategies together. When you are able to combine less correlated strategies, it is possible to smooth drawdown, boost win rate and therefore improve your overall risk-adjusted returns. In Amibroker it is possible to combine equity curves together so you can see […]

Filed Under: Amibroker, How to, LatestTagged With: amibroker, latest

By Joe Marwood9 Comments

How To Limit Risk And Capture Upside With A Barbell Trading Strategy

In this article I look at the advantages of a barbell trading strategy and then I put the strategy to the test using historical stock data. As you will see there are some pros and cons to using this technique.

Filed Under: Amibroker, Stocks, Strategies/ Systems, Top PostsTagged With: amibroker, stocks, strategies

By Joe MarwoodLeave a Comment

Analysis Of US Stock Splits

Conventional wisdom suggests that a reverse stock split is generally bad for a company’s stock. That’s because reverse splits are usually undertaken when a stock is in danger of being delisted. But is there any actual evidence that reverse stock splits lead to bad investment returns? And if there is, might you be able to make money from shorting reverse […]

Filed Under: Amibroker, Ideas, Stocks, Strategies/ Systems, Top PostsTagged With: amibroker, trading systems

By Joe Marwood3 Comments

Testing The RSI Model From The Quantitative Technical Analysis Book By Howard Bandy

Recently I have been re-reading the book Quantitative Technical Analysis by Dr. Howard Bandy. This is a hefty book filled with quality information and important ideas on the topic of system development.

Filed Under: Amibroker, Stocks, Strategies/ Systems, Top PostsTagged With: amibroker, systems

By Joe MarwoodLeave a Comment

Another Way To Sell Using Amibroker

There are more ways than one to exit a trade in Amibroker. It may sound obvious but trading strategies can benefit from being creative with exits as well as entries. In this post, I look at a simple way to come up with more flexible sell signals.

Filed Under: Amibroker, How toTagged With: amibroker, how to

By Joe MarwoodLeave a Comment

Candlestick Analysis For Professional Traders

Several months ago I was thinking about candlestick charts and whether or not these classic patterns had any predictive ability for trading. I had a look around but all I could find were vague speculations and cliches. I couldn’t find any solid evidence of whether they actually worked or not. So… I thought I would casually […]

Filed Under: Amibroker, Strategies/ Systems, Technical AnalysisTagged With: amibroker, candlesticks, strategies

By Joe Marwood12 Comments

This Simple Trading System Makes 170% A Year

Download the rules to a trading system that makes 170% a year in stocks. Regular readers of this blog will be aware that I like to create trading systems using Amibroker; a program which allows you to test various investment strategies on historical stock data.

Filed Under: Amibroker, Stocks, Strategies/ SystemsTagged With: amibroker, trading systems

By Joe Marwood4 Comments

Testing The Gravestone Doji Candlestick Pattern

In a recent article we looked at the shooting star candlestick pattern and we found that it wasn’t a particularly successful signal for spotting reversals. In this article we will look at another bearish reversal signal in the form of the gravestone doji candlestick pattern.

Filed Under: Amibroker, Strategies/ Systems, Technical AnalysisTagged With: amibroker, candlesticks

What’s New in the amibroker full version Archives?

Screen Shot

System Requirements for Amibroker full version Archives

- First, download the Amibroker full version Archives

-

You can download its setup from given links: